10 Best Bitcoin Trading Platform 2021

In addition to Bitcoin, the Crypto industry has over 1500+ other altcoins. The total coins capitalization is more than 750 Billion (May 1st, 2020).

Every day various crypto trading platforms move over $ 40+ billion in trades within only 24+ hours. If you’re interested in day trading, or holding, feel free to buy some bitcoins or other altcoins such as DASH, XMR, LTC, XRP, EOS.

The best cryptocurrency trading platforms I’ve enlisted below not only facilitate trades but also can help you buy bitcoin with wire transfer, with credit cards, with debit cards, Paypal online.

So in this piece I’ll walk you through some of the best Bitcoin market and trading platforms existing in the industry.

Before diving into this list on some of the Bitcoin Trading Platform, let’s share some points on what makes them the best, or what you should be eyeing for when searching for the best Bitcoin trading platforms.

Read Here: How to Create Bitcoin Wallet Online and Offline with Security Guide

Let’s understand the all best bitcoin exchange markets info by the help if top 10 Table. The table will help you for quick understand which best trading platform for the cryptocurrency.

| Markets | Website | KYC | Security | Fiats Supp. | Withdrawal Limit | Deposit Limit | USA Supp. | Withdrawal Fee | Exchange Type | Trading Fee |

|---|---|---|---|---|---|---|---|---|---|---|

| bitania.to | No | 2-FA, SMS Alert | Yes | None | None | Yes | Free | Centralized | 0% | |

| binance.com | No | 2-FA, SMS Alert | Yes | 2 BTC (Non-Varified) | None | Yes | 0.0005 BTC | Centralized | 0.1% | |

| paxful.com | No | 2FA, SMS, Email | Yes | None | None | Yes | Max 0.1% 0.0005 BTC | Anonymous | 0.1% – 1% | |

| bybit.com | No | 2-FA, IP Monitor, Email | Yes | Yes | None | No | 0.0005 BTC | Anonymous | 0.025% to 0.075 | |

| kucoin.com | No | 2-FA | No | 2 BTC/Day | None | Yes | 0.0005 BTC | Centralized | 0.1% | |

| coinbase.com | Yes | 2-FA, IP Monitor | Yes | $10000/Day | None | Yes | Depend on Country | Centralized | 1.49% | |

| phemex.com | No | 2-FA, IP Monitor, Email | Yes | Yes | None | Yes | None | Anonymous | 0.025% to 0.075 | |

| bitfinex.com | Yes(Fiats) | 2-FA, Adv. Monitoring | Yes | None for Crypto | None of Crypt. | No | 0.0004 BTC | Centralized | 0.1%-0.2% | |

| cex.io | Yes | 2-FA, DDoS Attacks, | Yes | $1000/Day | $1000/Day | Yes | Max 3% 5% Fiats 0.0005 BTC | Centralized | 0.25%-0.16% | |

| kraken.com | Yes | 2-FA, Master Key | Yes | $2500/Day | None | Yes | € 0.09 | Centralized | 0.16%-0.26% | |

| okcoin.com | Yes | 2-FA, Call Verification | Yes | $1M- $2M | $1M- $2M | Yes | Diff. | Centralized | 0.05%-0.15% | |

| localbitcoins.com | No | 2-FA, Login Guard | Yes | None | None | Yes | 0.0005 BTC | Anonymous | Depend on User |

If you are not getting sufficient information and still looking more crypto trading platform with description then you may go ahead, below I a describing every point that you should know before joining any listed bitcoin trading exchange. Let’s go!

How to choose the best Bitcoin exchanges

This is a complete guide that will help you understand the entire concept of Bitcoin trading exchanges, and the factors you need to consider before choosing one.

Note: Before we begin, I’d like you to take note of something really important. If you’re not a day trader and wish to hold Cryptocurrencies for the long run, never leave Cryptocurrencies on online exchanges. Always transfer and hold them in their associated crypto wallets.

- Reputation – An exchange’s reputation is of one of the primary factors you should look at. Check reviews, what other users are saying about it, its hack-history (if it has ever been hacked) and other such crucial information. You can find the information easily on social media sites, Reddit, Twitter and even on this very site. We’ve already published a CEX.io review and many others.

- Security – Ah! Security! It’s arguably “the” most important factor when choosing a Bitcoin trading exchange, isn’t it? If the exchange isn’t secure, it can be hacked, or may have technical faults which may result in the loss of your funds. Check what back-end security features an exchange has (its server locations, security measures, cold-storage availability etc.)

- Privacy Policy – Recently, Coinbase shared data of 32000 users with the IRS.Well, that’s a bummer, isn’t it? The entire point, or most of it, when it comes to Cryptocurrencies is “Privacy & Anonymity“. Hence, go through the privacy policies of these exchanges. See if they’ll share data with govt. agencies and in what scenarios. It’s best to go with exchanges which store the least bit of information about you.

- Fees – Multiple types of fee is associated with a Bitcoin exchange. There’s deposit fee, withdrawal fee, trading fee etc. This matters especially for day traders. If you’re a day trader, you’d be making multiple trades everyday, right? Hence, you’d be paying the fee for each trade.

- Payment Methods -These are Bitcoin “exchanges”. So, they primarily let users “exchange” Bitcoin for other Cryptocurrencies, and vice-versa. But, what if you don’t have Cryptocurrencies to begin with? How will you stat your trading career then? Well, this is why you should pay attention to the payment modes. Exchanges like CEX.io let you purchase Bitcoins (and other Cryptocurrencies) directly using your credit/debit cards, bank transfers, online wallets and many other similar modes. Hence, you can start trading even if you don’t already own Crypto.

- Verification Requirements – Some exchanges require KYC verification, others don’t. What suits you better is obviously a personal preference. Getting verified however helps you avoid money-laundering or tax-evasion charges and legal trouble. It also makes sure your card and bank details can’t be used without your permission. In the CEX.IO case, they offer credit cards, debit cards, wire transfer withdrawal/deposit and hence they first approve your cards or bank a/c detail before letting you make a transaction.

- Geographical Restrictions – Some exchanges only accept users from specific regions/countries. Or, in other words, some countries/regions are restricted and hence users from those regions aren’t allowed to use the exchanges. Always make sure to check (via live-support, or on the T&C page) that your country is supported by the exchange.

- Support – Obviously, you’ll be dealing with money. Hence, it’s best to go with crypto exchanges which offer live-support. Money issues shouldn’t have to wait hours or days to get sorted, right?

Factors to Look For in the Best Bitcoin Market

Bitcoin markets will without doubt share one common core point, that’s they all are there to facilitate the trading of Bitcoins. But there are quite a number of factors which makes them stand apart from the crowd and the reason why only some of the Bitcoin trading platforms are on this list and not the others.

Trade Volume

Trade volume gives you an insight of how much of Bitcoin the Bitcoin trading platform is handling on an average. If the number is high, it’s a clear indicator that the platform is trusted and has a good reputation.

Also it’s a general rule that trading platforms with more trade volume will find themselves closer to the average Bitcoin market value, while those with not as much trade value as them might venture away from that average.

(You wouldn’t want to miss the #10 on this list, especially in regards to Trade Volume!)

You can check the trade volume on the platforms themselves, or from a general trade volume index from Google.

Security Measures

Bitcoin is a digital currency, so it’s the equivalent of real money in the digital world, hence it’s important for the Bitcoin trading markets to make sure that there platform is as airtight as it can be.

So when choosing your Bitcoin trading platform you need to ensure that the platform you’re going with uses as many encryption protocols, security measures and methods to make sure your account and money are safe.

At the very least, a two-step verification is a must to begin with, after that there’s literally no end where this list ends, the more steps needed to get into your account, the better (even if it consumes a bit more time than general logins!)

Most Visited Post: What is Bitcoin and How does Bitcoin work?

Charges

Obviously, there are various amount and types of charges or fee any Bitcoin market incurs on its customers and clients. How much is the fee, and what are the grounds on which it’s charged also goes on to tell a reveal a lot about the platform.

The most obvious charge pattern is the charge on your amount of currency on a percentile basis. The more currency you trade, the more amount you’ve got to pay as its percentage.

While others might use other models where only “Buyers” pay a fee and not sellers, or one of them pays a reduced fee, this model is called the “Maker-taker” model.

There are a lot of different payment methods, the trick here is to ensure what’s your purpose of using the platform, how much currency you’re trading, and which method or structure suits you best.

The percentile basis is the most used method because on a small-mid range it works best in the favor of the users, but if you’re trading a lot of currencies, the other models might be more profitable for you.

Now these aren’t “all” the factors which decide the popularity or efficiency of Bitcoin markets, but they are the most obvious, easily identifiable and influential ones for sure.

Best Bitcoin Trading Platforms with detailed descriptions.

These best Bitcoin trading platforms have been chosen keeping all the above-mentioned factors in mind. Not all of these are equal, while some provide excellent anonymity others offer more payment options, every aspect varies and hence each one of these is a leader by itself.

Website: https://bitania.to

Bitania is a P2P cryptocurrency exchange with a completely different vision from mainstream trading platforms. In simple terms, you can think of it as a crypto marketplace where users buy and sell directly with each other—no middlemen, no corporate control, and most importantly, no KYC. Some call it the “eBay of crypto,” but with a strong emphasis on privacy.

On Bitania, you can trade Bitcoin (BTC), Litecoin (LTC), and Monero (XMR) directly with real people, not some centralized exchange that tracks your every move. Since it’s peer-to-peer, the exchange rates and payment methods vary depending on the user you’re trading with. This also means a massive range of payment options, as Bitania itself doesn’t impose any restrictions—users agree on the method that works for them, whether that’s bank transfers, cash, PayPal, or other payment systems.

Unlike traditional exchanges that demand intrusive identity verification, Bitania has no mandatory KYC—you stay completely anonymous throughout the process. Your financial privacy is never compromised.

To ensure safety, Bitania offers escrow protection, meaning funds are only released once both parties confirm the trade is complete. Users can also check public profiles and past feedback, ensuring they only deal with trusted traders.

Security is a top priority on Bitania. While many exchanges have abandoned privacy in favor of regulations, Bitania stands firm in its commitment to anonymous trading. There’s no centralized tracking, no identity verification, and for users who want maximum privacy, Bitania even offers access via Tor onion services.

Bottom Line?

Bitania is a truly decentralized, privacy-focused alternative to mainstream exchanges. If you’re looking for a place to buy and sell Bitcoin, Litecoin, and Monero without sacrificing your anonymity, Bitania is one of the best options available today.

🚀 No KYC. No tracking. Just pure, private crypto trading.

Website: https://www.binance.com

Binance is one of my personal favorite exchanges for a number of reasons, one of them being I’ve made most profits over there, with the least restrictions.

Binance is one of my personal favorite exchanges for a number of reasons, one of them being I’ve made most profits over there, with the least restrictions.

It has become one of the best and most used exchanges (in terms of trading volume) since early 2018.

For starters, it’s one of the very few Bitcoin exchanges in 2021 which let you start trading with absolutely 0 identity-proof or KYC requirements; meaning you can just signup and start trading with absolute anonymity.

There however are limits for un-verified accounts, those are only allowed to withdraw a maximum of 2BTC in 24 hours. Level 2 KYC-verified accounts can withdraw upto 100BTC/24 hours; while Level-3 accounts have a much higher, undisclosed limit.

It was a crypto-only exchange earlier; but they recently started letting users buy Fiats directly using their Credit cards via Simplex. Although currently only BTC, XRP, ETH, LTC and BCHABC can be bought directly from cards.

The fee for buying directly using cards via Simplex (the payment processor) is 3.5% of the transaction, or USD $10.00 (whichever is higher). The fiat-purchase is also limited at USD $20,000/user/day; or USD $50,000/user/month. There also is a minimum USD $50.00 purchase limit.

As of today, Binance has added quite a few other fiat payment modes. Now you can also purchase Cryptocurrencies using 2 other options in addition to Simplex.

The first being- from vendors on the marketplace. This essentially makes it a P2P exchange like Paxul or LocalBitcoins. The payment modes for P2P exchange include QIWI, bank transfers, Alipay and Wechat.

The second new mode of fiat payment on Binance is- 2 additional payment processors, these include Koinal and Banxa.

Koinal is special because it’s absolutely free for purchases worth over $1000.00. As for minimum limits, Koinal has a minimum requirement the same as Simplex, $50.00. Banxa on the other hand also facilitates trades as small as $30.00.

Sure, maximum limits exist as well. With Koinal, you can purchase a maximum of USD $20,000 worth of USD/day. Banxa seems to be made for smaller traders (in trade volume). Just like it’s lower minimum limit, its maximum limit too is capped at just $5000.00/day.

Banxa accepts bank transfers, cards, POLi payment, BPay, PayID, EFTPOS/ and Newsagent in-store cash. The exact fee you’re paying with Banxa would depend on the payment processor being used. It can be anywhere between 0% (POLi) to 3% (BPay).

It also is one of the most extensively ERC-token accepting exchanges; meaning there are over a 100 different tokens and coins you can trade on Binance.

There’s absolutely no deposit fee. The Withdrawal fee is adjusted regularly according to market conditions, however at the time of writing this article BTC withdrawal was priced at 0.0005 BTC/withdrawal with a minimum Withdrawal limit of 0.002BTC.

The trading fee is 0.1% generally; but it has this unique feature of letting you use BNB Coins for the fee; in which case the fee is discounted at 50% for the first year, 25% for the second year, 12.5% the third; and 6.75% for the fourth year. So users have to start paying 0.1% fee (or the 100% of the then-fee amount) only from the 5th year!

The exchange supports all the countries on the planet except- Ivory Coast, Kyrgyzstan, Lebanon, Congo (Kinshasa), Cuba, Korea, Eritrea, Iran, Iraq, Libya, South Sudan, Sudan, Afghanistan,China, Congo (Brazzaville).

And even though it supports U.S; some states including NYC, Georgia, New Mexico, Hawaii, Connecticut, and Washington aren’t supported.

You May Like: How to Access the Deep Web

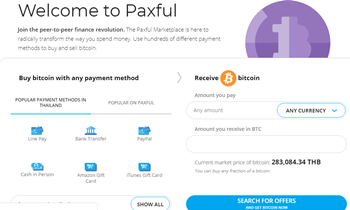

Website: https://paxful.com/

Paxful recently re-designed themselves and jumped right to the top when it comes to being the best Bitcoin trading platforms. It’s a P2P exchange, which connects buyers and sellers and only acts as a mediator.

It has absolutely no geographical restrictions. Almost always you can find a trader who’s willing to sell to you, or buy from you Bitcoins regardless of where you’re from.

Most low-level traders can sneak around without having to complete any KYC verification whatsoever. KYC is only mandatory for traders trading over USD $1500.00 worth of coins.

Another feature making it the right pick for this best Bitcoin trading platforms is its acceptance of over 300 different payment modes! Everything including Gift cards, PayPal, Mobile refills, direct cash, Bank Transfers, Cards, Western Union and everything else in between is accepted.

Bitcoin can be traded for 26 other Cryptocurrencies as well, a user can send or receive ETH, LTC, XLM, XRP, NANO, NEM, USDT, TRX, EOS, WAVES and many other Cryptos in return of BTC.

As for security, Paxful has been globally recognized by some of the biggest names in the industry as one of the most secure trading exchanges. It makes sure you get your end of the bargain and aren’t scammed by the other party. There’s 2-Factor authentication coupled with the extensive background information available for each user (both Buyer and Seller).

Note that the buyer doesn’t pay any extra fee (apart from the seller’s selling price) on Paxful, rather only the sellers are charged and the fee is based on the “mode of payment accepted” by the Seller.

Website: https://www.bybit.com/

ByBit doesn’t need KYC, so feel free to continue reading without that Elephant in the room. It’s the only trading exchange I’ve seen which offers “bonuses” just like the best Bitcoin casinos do. Up to $90.00 can be claimed for free simply for following them on Twitter, completing surveys, trading actively for 10+ days and so on.

It too, alike Phemex believes in paying the makers for trades. Makers earn a 0.025% rebate on trades, and takers pay 0.075%.

Unfortunately, fiat deposits aren’t supported (yet). They only support deposits and withdrawals via BTC, ETH, XRP, EOS and USDT. Deposits are completely free. Withdrawals are priced at 0.0005BTC, 0.02ETH, 0.2EOS, 5 USDT, 0.25XRP.

Every cryptocurrency also has its own minimum withdrawal limit, which is – 0.002BTC, 0.02ETH, 0.2EOS, 20XRP, and 50 USDT.

2-FA and cold storage ensure account and fund-security. It’s not available in the U.S.A, Singapore, Cuba, Crimea, Iran, Syria, North Korea, Sudan, Sevastopol, and Qubec (Canada is not restricted as a whole). The live-chat is available 24X7, the response-time is impressive and the answers are detailed.

LocalCryptos

Website: https://localcryptos.com/

LocalCryptos was earlier known as LocalEthereum. Now they allow the buying/selling not just for ETH but for almost any other cryptocurrency including BTC, LTC, DASH or anything else.

This is basically a LocalBitcoins clone, but without any of the red tape. Meaning, it’s 100% anonymous and accessible for anyone. No documents/personal information is asked for signing up or trading.

It too is a P2P exchange where people buy and sell Cryptocurrencies. It allows making payments using 40+ different methods.

It’s also “non-custodial”. What this means is, the company never gets hold of your coins. They’re controlled completely by you using your own private keys.

The market acts as an escrow between the buyer and the seller. All communication between the two parties (Buyer & seller) is E2E encrypted. It can’t be decrypted/intercepted by anyone else.

It’s pretty cheap and only requires 0.25% when you post an offer. You can also directly respond to offers posted by others if you’re in a hurry, in this case you’ll be paying 0.75% of your transaction as the fee.

Because it’s decentralized, there are no restrictions whatsoever. You can use it from anywhere in the world.

Website: https://www.okcoin.com/

OK Coin leads with the tagline- Leading Global Digital Asset Exchange, and with a trading volume of 218BTC (8,67,731.56 USD exactly according to the current rate) it may not be the most used Bitcoin trading exchange in 2021, but sure tops the charts.

The User-interface is pretty simply and easy to understand for starters.

It offers two types of accounts, Personal and Institutional although does require intensive identity verification for each so it’s not strong on the anonymity. They have three verification level, and in order to trade users have to be atleast level 3.

The verification takes a maximum of 48hours in most cases; and is most often completed in less than a working day.

There are absolutely no trading limits unlike some other best Bitcoin exchanges of 2021 on this list; however KYC-2 level users get to deposit a maximum of USD $1,000,000.00/day; as for withdrawal a total of USD $1,000,000.00 (combined for Crypto tokens and fiat currencies) can be withdrawn.

For KYC-3 users; the daily fiat deposit limit is USD $2,000,000.00/day and for withdrawal it’s again a total of USD $2,000,000.00/day combined for Tokens and Fiats.

Their deposit-fee is as follows (and I quote from a live-chat with “Nesh”, an OkCoin representative)- Regarding OKCoin Fiat Deposit we have 4 methods:

“Bank Card Transfer” and “Epay” -> 1% fee from OKCoin

“Silvergate Bank” and “Signature Bank” -> no fee from OKCoin

Deposits can be made using Paypal, Credit/Debit cards, Bank transfers and also via SilverGate for U.S customers.

As for trading fee; it differs based on the amount being traded:

- For amounts below USD $100,000 it’s 0.05% for the Maker and 0.15% for the Taker.

- USD $100,000 – USD $1,000,000 it’s 0.02% for the Maker and 0.12% for the Taker.

- USD $1Million – USD $5Million – Absolutely free for the Maker and 0.10% for the Taker.

- Above USD $5Million – Free for the Maker, 0.05% for the Taker.

Withdrawal fee is 0.1% for OKCoin and has to be a minimum of USD $15.00; 1% for EPay and as for bank withdrawals will depend on individual banks.

Account security features include 2-FA via either Google Authenticator, or SMS. They even have a “call-verification” firewall in place in case the system senses a withdrawal request to be suspicious.

They’re available in almost all the countries on the planet, with the only exceptions being – Crimea, Sudan, Bangladesh, Bolivia, Ecuador, Kyrgyzstan Syria, Malaysia, Cuba, Iran and North Korea.

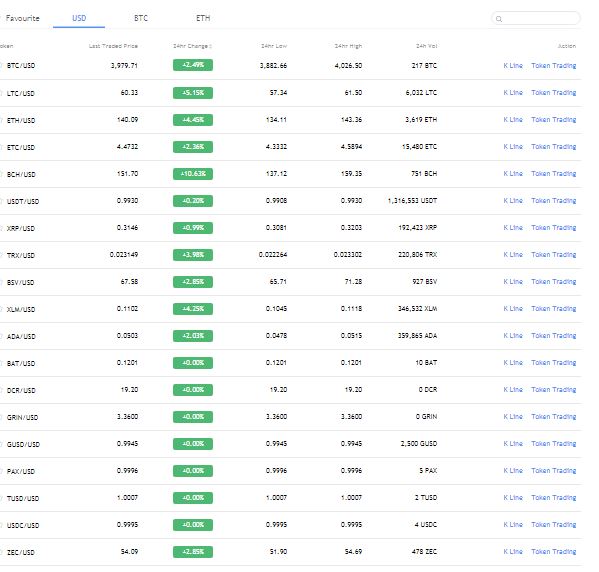

The trading pairs may not be as extensive as Binance; but do include some of the most common ones such as /USD, /BTC as well as /ETH. Here’s the full list-

They do have an extremely secure cold-storage for safe-keeping majority of the funds. Lastly; their support is truly one of the fastest, and most “personally involved” supports I’ve ever talked to; they do the legwork for their users and will actually try to eliminate user problems from their end instead of redirecting you to various links.

KuCoin

Website: https://www.kucoin.com

KuCoin is a new player to the Bitcoin exchange game, however since its angel investment round in August it did skyrocket its performance, availability, features and everything else.

Although it’s still not as feature-rich as some other Bitcoin exchanges mentioned on this list; it doesn’t support Fiat deposits to begin with; no fiat payment methods are supported for withdrawals either.

So all you can do on KuCoin is; send in crypto which you already own > trade the currency you sent for other coins. It doesn’t even allow withdrawing funds directly in any fiat form; and hence users need to send the funds to other exchanges and then withdraw them if they want to.

It requires KYC verification although the good news is they aren’t absolutely mandatory, meaning even non-KYC verified members can trade on the platform although they’re limited at 2BTC withdrawal/day, although verified members have an extended limit of 100BTC withdrawal/day.

As for institutional accounts the limit can be extended upto 500BTC/day.

As for the fee; and I quote a KuCoin representative- “The Maker and Taker base transaction fees for all trading pairs are 0.1% (Except for the GGC trading pairs, which is 0.25%).”

For account security they offer 2-FA via Google Authenticator and even SMS, although the SMS feature is only available in:

- China

- Indonesia

- Turkey

- United Kingdom

- Philippines

- Canada

- Thailand

- United States

- India.

Trading Passwords are another security fail-safe which can be set on the platform, they are like 2-FA but not for login rather are used for transactions, withdrawals and other major fund-related activities. Advanced features such as an anti-phishing mechanism as well as Login safety phrase are available as well.

Website: https://phemex.com/

Phemex despite being one of the newest exchanges, is one of the best Bitcoin trading exchanges for more than one reasons. For starters, it doesn’t require KYC and that’s extremely rare to come by these days. It’s based out of Singapore, so that’s neutral ground as far as regulatory compliances go.

Currently, it only supports BTC deposits. However, trades can be placed for ETH, XRP, LINK, LTC, XTZ etc. It also is soon incorporating real-world, public equity stocks but as of now that hasn’t happened yet.

The one downside is only /USD pairs are supported. So, we can’t yet trade for BTC/XRP, BTC/ETH and so on .The funds need to be deposited in BTC only, then converted to USD, and then traded for other Cryptocurrencies.

Bitcoin deposits require only 1 confirmation to be considered valid. It’s rarest of those marketplaces which actually PAY users to trade. Makers get paid a 0.025% on their trades on limit orders. For takers, the fee is 0.075%.

Both the minimum deposit and withdrawal have a requirement of 0.00000001 BTC. There’s absolutely no deposit or withdrawal fee.

It’s extremely serious as far as security goes. 2-FA (via Google Authenticator) is mandatory. Cold-wallets exist for extra security. Double-entry bookkeeping prevents fraud and other similar actions in an account.

It’s also one of the very few Bitcoin trading platforms which provide a 24X7 live-chat. Up to 100x leverage trades available. U.S.A is the only country it can’t be used in.

Bisq

Website: https://bisq.network/

100% anonymous and private. That’s the primary USP Bisq network sells itself on. It has clearly stated that absolutely no document or identity verification is required to trade on Bisq.

It’s basically a decentralized, P2P exchange and buying platform. Meaning, you can use it to buy and sell Cryptocurrencies for fiat, with 100% anonymity.

It doesn’t even require registrations!

It’s not web-based and rather require installation on your system. On the brighter side, the app is completely open-source. So, there are no backdoors whatsoever.

You can either go to someone else’s offer directly, or create your own offer when buying/selling your funds.

As for Payment methods, almost everything on the planet except PayPal and Credit Cards (to prevent chargebacks) are available.

It takes special care of security as well. For starters, funds aren’t controlled by Bisq once deposited. Rather, they’re held in a 2 of 2 multisig wallet.

No data is stored on Bisq either. In fact, it doesn’t even use central servers! It’s all routed over the Tor network by default.

As far as scam measures go, it has a signing mechanism which gradually increases trade-sizes. This prevents new, potential scammers from using the platform.

The fee is set a 0.1% for makers and 0.7% for takers.

CEX.IO

Website: https://cex.io/

Cex.io has it clearly listed on their homepage that it’s a Bitcoin market which facilitates simple Bitcoin trading, Bitcoin Wallet, where you can buy Bitcoins and sell Bitcoins, as simple as that. They have their base in almost 99% of the countries on the globe hence confirming their strong base in the Bitcoin market.

Starting with the payment methods, it supports a wide range of options including Credit/Debit Cards, Bank Transfer and even cryptocurrency!

As far as security goes, it has a strong encryption algorithm which protects it against any kind of potential threats, hence your currency is safe.

Also it has a special maker-taker model where the “maker” doesn’t have to pay any fee! Well yeah, it’s 0% for them, only the taker bears the fee and even then it’s pretty lucrative and not heavy on your pockets.

Or if you trade n bulk, in that case, it has a special high-volume trade fee structure so you pay lower than you normally would have to.

Read Review: Cex.io Crypto Exchange Review

Not to mention that it allows Margin Trading, where you can borrow money and hence trade more than you would have been able to on your own currency. It supports margins of 1:2 and 1:3 currently. And the best part is it’s all automated!

You can currently trade with BTC, ETH, DASH, LTC, XRP, BCH, XLM, TRX, MHC, NEO and many other coins on CEX.

No mention of Cex.io anywhere can be complete without mentioning its recently integrated advanced stacking feature. Stacking is a popular “investment” model in the crypto industry. It simply means depositing funds on a platform and the platform pays you an interest on your coins simply for keeping the coins there.

However, CEX’s stacking is unique. It’s one of the very few stackers which allows you to “use” your coins even when they’re stacked. In other words, your coins aren’t “locked” for any period of time. They’re yours, use them, trade with them, withdraw them anytime you like.

But for as long as the coins remain on the exchange, you get an interest! The interest rate differs, it can be as low as 1-3% for NEO, while as high as 15-20% on Metahash (MHC)

The coins currently stackable on CEX include NEO, ONT, TRX and MHC. So basically if you hold 1NEO (this is the minimum requirement), you’d be paid 1-3% of your held amount in GAS. The reward coin doesn’t always change, for e.g. holding TRX or MHC results in your interest being paid in TRX and MHC without change.

Website: https://localbitcoins.com/

Website: https://localbitcoins.com/

LocalBitcoins is a Bitcoin market with a totally different vision and environment. In simple words, it can be explained as a Bitcoin forum where you actually meet with the person who’s selling or buying your Bitcoins.”Ebay of Bitcoins” describes it just fine.

You can either buy or sell your Bitcoins online on Local Bitcoins directly to other humans. LocalBitcoin servers as an online wallet, an escrow system to facilitate a safe deal.

Because of the fact that you deal with a human and not an online market or computer, the exchange rate and payment method differs based on the person you’re trying to sell or buy it from, as they might be from different countries, have different currencies and might prefer different payment methods.

But this also ensures a wide-range of payment options, in fact, it can be said that LocalBitcoins supports almost every payment method on the planet, because if the other party wants a Paypal transfer, Wire-transfer or anything else, it doesn’t matter as you can always make it separately and there’s no involvement of LocalBitcoins on that front mandatory.

As a safety measure, you can check any person’s “public history“, so people with high scores indicate they’re legit and can be trusted. The Escrow service from Local Bitcoin ensures that the seller gets their money only after you’ve confirmed receiving of the Bitcoins, and vice-versa.

Obviously, two-step authentication is available and works towards making your LocalBitcoin account and wallet secure. If that’s not enough for you for some reason, there’s an extra security layer called “login guard” which makes sure you’re using the same device and same browser everytime, if not an extra e-mail confirmation is required to login.

Bottomline? LocalBitcoins is a Bitcoin market which decentralizes and humanizes Bitcoin trade.

Update: LocalBitcoins now requires Mandatory KYC verification in most cases, and hence has been moved to the bottom of this list considering how we take your anonymity seriously and only prioritize anonymous best trading exchanges.

Website: https://www.coinbase.com/

Website: https://www.coinbase.com/

Coinbase is without doubt one of the best cryptocurrency trading market in the industry, it also is one of the most professional options when it comes to a Bitcoin market.

It offers simple buying and selling of Bitcoins, in one of the most secure environments in the industry.

It uses the “Dollar cost averaging” method and allows quite a bit of automation to you as a user. Primarily you can automate purchase and sales of Bitcoin without you having to touch the computer.

The initial “buying” limit is restricted to a lower amount, and is raised later when you start bitcoin trading more frequently and in higher amounts. You can use a Credit Card/Debit Card and any proof of identity to raise your limit with Coinbase.

The limit also varies based on your residence, type of citizenship and method used to purchase Bitcoins. The highest limit is $50,000 worth of Bitcoins/day for a completely native and/or verified US resident.

Also ACH payment method will clear you for a higher limit compared to using a Credit card for the same. It was initially launched only with “Wire transfer” as funds transfer method, but has been equipped with Credit/Debit and Paypal payments as well.

Popular Post: Best VPN for Torrenting P2P And Filesharing 2017

The processing fee differs based on Payment method and country. It’s generally around the brackets of 1%-3.5% based on the difference in factors.

The only downside is, you’ve got to be professional while using Coinbase. If you’re trying to use Coinbase for anything that’s even remotely not on the brighter side of law, your account has a good chance of getting suspended.

BitFinex

Website: https://www.bitfinex.com/

They claim to be the world’s largest Bitcoin trading platform and well with a 24 hour trade volume of $128,743,404, it’s really acceptable isn’t it?

First and foremost reason why BitFinex deserves to be on this Bitcoin market list is because of their magnanimous trade volume!

Their trade volume was $625,808,722 for 7 days, and $1,425,215,354 for a month a year ago; even then they were practically demanding trust, but today even after BTC has lost over 80% of its then-value; they have a 24-hour trade volume of $195,177,028, a 7-day volume of $876,212,297 and $5,266,357,228 for a month! These numbers do establish the fact that BitFinex is still one of the best BTC exchanges in 2021!

Secondly, they claim to have the minimum slippage during an exchange, and support a wide range of options apart from Bitcoins, including Ethereum, Zcash, Litecoin and Monero to name just a few.

And their security measures are seriously one of the best I’ve ever seen with any Bitcoin market:

- Two-factor authentication

- Advanced Monitoring

- Login Data is monitored.

- IP Address based restrictions.

- Instant account freezing option via E-mail.

And that’s not all! They even monitor “Withdrawal requests”, and in case of a foreign IP address, or any unusual activity the request is paused and a manual inspection is commenced.

And another one of their features is the ability to let you add “Address Whitelist” so the only place your Bitcoin can go is that specific address and no where else.

The currency is stored in cold-storage, with only 0.5% of the currency being kept in hot-wallets for everyday transactions.

Even the cold-wallets are protected, and require high-level manual access from the team to be transferred anywhere else!

So the one thing you’re definitely getting with BitFinex is top-notch security for your funds.

They offer “Margin Trading” as well with a leverage of 3.3x which can be completely automated.

As far as interface or customization is concerned, they not only offer some of the best looking dashboards, but they can be completely customized from your end as well!

And obviously their API is advanced enough for you integrate with any of your custom made tools to monitor pre-made charts, create your own charts, edit orders automatically or anything else based on your skills and creativity.

Fee structure is based on the Maker-Taker model. It starts with a 0.100% for Makers, and 0.200% for takers percentage. And gradually decreases up to the point of $5,000,000, after which point the fee is completely revoked and trading is free for the makers.

LakeBTC

Website: https://www.lakebtc.com/

LakeBTC is best known for its security measures and transaction fee, which equally competes with the fee of any other large Bitcoin trader in the industry since its early days.

The other feature worth pointing out is its huge currency support! It supports USD, HKD, GBP, AUD and almost all the other commonly used currencies.

It offers great liquidity to individuals and institutions as well, and is a part of some of the largest Bitcoin indexes on the planet including IRBA and CFTC.

They use a trader-maker model by default, where the taker pays 0.2% on all the transactions, while the fee for the maker differs based on different factors.

Free:– For makers with volume >20,000BTC

0.02% if the volume is >15,000 but <20,000

0.04% for >6,000 BTC

And it grows up to a mark of 0.15% if the volume is lower than 500 BTC and is then consistent till you cross the 500 BTC mark.

BitStamp

Website: https://www.bitstamp.net/

BitStamp is another giant in the line of facilitating Bitcoin trading in the Bitcoin market with an average 30-day trade volume of 222,000 (meaning lower Bitcoin prices and bulk buying opportunities for you!) And also is the first “Nationally Licensed Operator” on the planet.

The primary edge they get over other platforms is their ability to accept a number of currencies, ranging beyond just “US Dollars“, including Euros, British Pounds and Francs (Switzerland) as well!

As far as processing fee goes, it has a very simple calculation to that. It uses the “percentile” system we talked about, you generally pay 0.25% for $20,000 and it keeps dropping as the amount increases. The lowest mark being 0.10% at $20 Million!

You obviously get the two step authentication that almost every single Bitcoin market I’ve listed in this list accounts for, so in addition to your Password, you’ll also need to verify a custom OTP every time you try to login.

Although you can’t use “Paypal” to purchase Bitcoins, and that’s totally natural because of the “Refund” feature from Paypal which might lead to fraudulent activities from buyers if they are capable of reversing the transactions later.

The other factor which you might not be excited about is the fact that it does collect a bit of “personal” information, although nothing that’s too personal, and it gives us a clear insight so as to how the information will be used, and under what circumstances.

Visit Here: Darknet Markets Links (Alphabay, Dream, Crypto, Hansa, Valhalla)

Kraken

Website: https://www.kraken.com/

This is an extremely “Trade” focused Bitcoin market. But if that’s what you’re looking for, you’re exactly where you should be. Offering great Bitcoin pairs like JPY, GBP, EUR, USD it makes for one of the best Bitcoin trading platform in the industry.

Also, I personally love the security, it uses two-factor authentication just like any other security conscious Bitcoin market, in addition to its PGP and GPG encryption algorithms.

If that’s not enough you can also initiate a “Master Key” for added protection to your accounts.

Apart from the two-step authentication and encryption, it uses a “cold wallet” to store the digital currencies. Meaning all new deposits will be stored in an environment which is completely isolated from any online system.

It uses two other kinds of Bitcoin wallets, semi-cold and hot to store currencies for different purposes. Point being, it’s secure, period!

Another one of the features I love about Kraken is its ability to let you use “Leveraged trading”, meaning you’re allowed to use as many as 5x shorting!

Finally, it uses tier-based fee structure, which is in a way the opposite of the “percentile” system we’ve seen. In this system, the more currency you’re trading, the lower fee you’ll have to pay. And that fee is paid on a /trade basis and not on a renewal or scheduled time.

The “Maker” always has to pay a lower fee as a general rule for almost any other Bitcoin market, while the taker bears a bit steep fee amount.

itBit Trust

Website: https://www.itbit.com/

ItBit Trust has quite a number of factors why it can be trusted and is one of the first names in the Bitcoin market these days. First, it has been registered as a “trust”, so it operates in every state of the United States, and it has the deposits insured by the FDIC.

Secondly, its board of directors have been known to wield extreme power themselves, ranging from ex-US Senators to the chairman of the FDIC. Hence “trust” can’t be an issue with itBit Trust that’s established.

The fee structure is the “Taker and Maker” model, and it’s fixed. The taker has to pay 0.35% and the maker 0.50% transaction. Although they offer a “Personalized fee structure” for institutions or if you’re an avid trader.

As far as trade volume is concerned, it is 4,109.70XBT at the time of writing this piece, which is more than impressive.

To top it all up, they use 100% cold storage for storing their Bitcoins, so security once again is not something to be challanged with itBit Trust.

Even their APIs are boasted of as “Fix and Rest“, so if you’re someone who needs direct access to their back-end, or goes with API integrations, itBIt Trust won’t disappoint you.

BTC-E (Seized by FBI)

Website: https://btc-e.com/

BTC-E is one of the major Bitcoin trading platform in the industry. So much so that it holds a majority of trade percentage in the total global BTC trade, which was 2.5% of all the Bitcoins being traded on the planet in the early days.

BTC-E’s metatrader allows Bitcoin shorting on the ratio of 3:1. It allows withdrawal via some of the most common and popular payment portals, including Paypal, Webmoney, Perfectmoney, and Ukash!

It supports USD, Euro, British Pound, Ruble and even the Chinese Yuan! And not just that, other cryptocurrencies like Namecoin and Litecoin are accepted as well.

It also has a chatroom for buyers and sellers to interact so if you feel lost you can always get almost instant support from others without needing to get the support team involved.

Without a doubt, it offers two-factor authentication for an extra security layer on your account.

The transaction fee is 0.20%/transaction generally, but it might differ based on your location and currency. As the USD is charged as 0.50% /transaction and the same holds true for Rubles as well.

It has a current trade volume of $20,341,900 which accounts for 39.71% of the total trade volume on BTC-E.

BitQuick.co

Website: https://bitquick.co/

BitQuick.co is a Bitcoin market that greatly resembles LocalBitcoins (just faster!). BitQuick too is a platform where you can find real people to interact with, and can buy or sell Bitcoins directly to them.

BitQuick acts as an escrow service between you and your other side, regardless of them being a buyer or a seller. The buyer pays a transaction fee of 2% (which is a bit high compared to other platforms out there to be honest!) , while it’s completely free for the sellers.

It’s best to use if you’re a seller and are looking to load off some BTC quickly. Again, as it’s “people powered“, the exchange rate and the payment method would vary depending on the person with whom you’re interacting.

But obviously you get more options as you can use any option even outside BitQuick to complete your transaction.

Put simply, they take the “hassle” out of any Bitcoin trade. As the name suggests, they’re fast, and simple, period. On an average, coins get reflected in your account within 20-30 minutes on a maximum (although a 3 hour grace period is officially demanded!)

DigiFinex

Website: https://www.digifinex.com

The primary benefit we as users get on DigiFinex is its anonymity. It doesn’t need KYC to be completed in order to trade or withdraw funds from the platform. However, KYC verification is available.

The fee is based on the Maker-Taker model as is the tradition in most cases. The lowest possible fee is – 0.03%. The fee structure however is slightly complicated and depends on “Boards“. The takers pay a 0.2% fee for all the boards.

Deposits can be made using Cryptocurrencies directly, or using a Credit Card. Obviously depositing Cryptocurrencies is free, Credit Card deposits on the other hand are charged at 4.5% (or USD $10.00, whichever is higher).

What’s the smallest amount you can deposit? That would depend on each currency you’re trying to deposit for Cryptocurrencies. Deposits via Credit Cards must be a minimum of USD $50.00. Doesn’t feature a cold-storage. Not many other security features are available either, except 2-FA.

It’s semi-global, U.S and Singapore citizen/residents can’t use it. And a number of other countries are only allowed to use its “crypto trading feature” but aren’t allowed to deposit fiats. Does feature a Mobile App, also offers OTC Trades. Margin trading too is available although get involved at your own risk.

Poloniex

Website: https://poloniex.com/

If you wish to start with Bitcoin investing, Poloniex is a pretty good place to do that. The first reason for that it is doesn’t require any KYC or identification whatsoever. You sign up with an e-mail, buy/deposit funds and start trading.

It also allows withdrawals up to $10,000.00/day without any KYC and that’s another reason why it’s on this list.

The standard trading fee is 0.125% for both maker and taker. There’s a discount if and when TRX is held in the account, and used to pay for the fee.

The fee still primarily depends on the trade-volume. The more you trade, the cheaper the fee gets. There’s no deposit fee.

Although, you’re here for the best BTC trading platforms, aren’t you? It isn’t “the” “best” for a simple reason, there’s no “market trade” feature. Only limit trades can be made.

Secondly, the worth of the funds in your wallet isn’t real-time. It takes a few seconds and minutes for the funds to be updated with their actual market prices. However, it still makes for a pretty decent trading platform.

It also pays simply for holding funds (Staking) on the exchange. There’s also a “lending” feature which can be used to make some profits.

eToro (Scammer)

Website: https://www.etoro.com

eToro isn’t just a Bitcoin trading exchange, not even just a Cryptocurrency exchange, rather a complete trading solution which lets users trade ETFs, commodities, Stocks, Indices and then obviously also Cryptocurrencies.

The program had a short-run in the U.S but was pulled off the U.S market due to conflicting govt. policies; although they did announce of a new Crypto exchange which would be available in U.S soon.

Currently it doesn’t support a lot of Cryptocurrencies but is limited to around 15 of them; including Bitcoin, ETH, LTC, BCH, XRP, ADA, NEO, TRX, BNB etc.

The Fee-structure is where most users get confused, considering how it’s not as simple or straight-forward but what you need to know is there’s a Withdrawal fee of USD $25.00 on each withdrawal; so it’s advised to cash out in bulk so you don’t lose a lot of money.

There also is an inactivity fee, charged on accounts which haven’t been logged into for the past 12 months; and a sum of USD $10.00/month is charged every month that the account remains inactive.

As for the conversion fee, when users buy Crypto on eToro using Fiat; there’s an eToroX fee of 1% or when Simplex is used it’s 4% of the transaction. The maximum deposit possible varies depending on the mode of deposit.

Also there’s a minimum Fiat-to-Crypto limit of USD $125.00, while the maximum being USD $10,000/transaction, there however is an additional daily limit of USD $20,000 followed by a monthly limit of USD $50,000.

Converting one Cryptocurrency to another on eToro isn’t free either and is charged at 0.1% of the transaction, followed by a minimum Crypto-to-Crypto conversion limit of 0.006 BTC/conversion and a maximum-unit limit of 3 BTC/transaction (varies for each Cryptocurrency).

It’s an extremely by-the-books organization and hence requires extensive KYC verification for users to use the platform. Also it’s not available in the following countries – USA, Myanmar, North Korea, Cuba, Sudan, Syria and Iran.

Lastly, it offers users a free, demo-account with USD $100,000 in virtual funds which can be used to learn, understand and get a lay of the field before jumping in with real cash.

Important tips for using the best Bitcoin exchanges

We’re sure you’ve found your favorite crypto exchange by now. However, without following the proper security measures, you’re at a high risk of losing your account!

Just make sure you follow these and you would mitigate most of your fund-losing risks.

- Enable 2-FA: Always enable 2-FA before depositing funds on these exchanges. These exchange accounts are prime targets for hackers.

- Recovery key: This is of utmost Depending on the exchange, you may have different modes of account recovery. Often, it’s your 2-FA recovery seed (for Google Authenticator). Make sure you make multiple copies of this. You lose this, you lose all your funds.

- Diversify : Never deposit or keep all your funds on any one exchange. Either use multiple exchanges or multiple cryptocurrency wallets to store your funds.

- No surplus: Only keep the exact amount you’d trade with on any exchange. Do not keep any surplus on these exchanges.

- Discount: Most exchanges offer a “fee discount” if you keep specific type of cryptocurrencies in your wallet. For Binance it’s the BNB coin, for Poloniex it’s TRX and so on. Deposit small amounts of these to cover your fee. The discount really adds up to significant profits.

Popular selected Cryptocurrency wallets review:

- Best Bitcoin Hardware Wallets with Comparison Chart

- Ledger Blue Hardware Wallet Review

- Ledger Nano S Hardware Wallet

- Trezor Hardware wallet Review

- KeepKey Hardware Wallet Review

- How to buy Bitcoins with PayPal

- How to buy Bitcoins with Credit Card

- How to buy Bitcoins with Debit Card

- How to buy Bitcoins with Cash

- Best Trading platform for Trade

- Electrum Wallet Review

- Exodus Wallet Review

- Blockchain Wallet Review

- How to open your bitcoin account

Final Words:

So that was the list on some of the best names which popup on ” Bitcoin Market ” talks in the online or offline world folks. If there are some other names you’d like to see up on this list, feel free to use the comment box.

Also note that the “trade volume” and other such real-time data is correct for the time of writing this article and might slightly differ by the time when you’re reading this piece.

Do let me know which Bitcoin market you use, and why! Also what are the factors you consider while choosing your best Cryptocurrency trading markets? The comment box is all yours.